Abstract

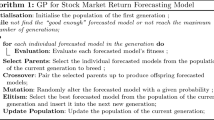

The purpose of this article is to present a novel genetic programming trading technique in the task of forecasting the next day returns when trading the EUR/USD exchange rate based on the exchange rates of historical data. Aiming at testing its effectiveness, we benchmark the forecasting performance of our genetic programming implementation with three traditional strategies (naive strategy, MACD, and a buy & hold strategy) plus a hybrid evolutionary artificial neural network approach. The proposed genetic programming technique was found to demonstrate the highest trading performance in terms of annualized return and information ratio when compared to all other strategies which have been used. When more elaborate trading techniques, such as leverage, were combined with the examined models, the genetic programming approach still presented the highest trading performance. To the best of our knowledge, this is the first time that genetic programming is applied in the problem of effectively modeling and trading with the EUR/USD exchange rate. Our application now offers practitioners with an effective and extremely promising set of results when forecasting in the foreign exchange market. The developed genetic programming environment is implemented using the C++ programming language and includes a variation of the genetic programming algorithm with tournament selection.

Similar content being viewed by others

References

Azzini A., Tettamanzi A. (2008) Evolving neural networks for static single-position automated trading. Journal of Artificial Evolution and Applications 2008: 1–17

Burney S., Jilani T., Ardil C. (2005) Levenberg–Marquardt algorithm for karachi stock exchange share rates forecasting. World Academy of Science, Engineering and Technology 3: 171–176

Deitel H. M., Deitel P. J (1994) C++ how to program. Prentice Hall, Englewood cliffs

Dunis C., Williams M. (2002) Modelling and Trading the EURO/USD exchange rate: Do neural network models perform better?. Derivatives Use, Trading and Regulation 8(3): 211–239

Dunis C., Laws J., Sermpinis G. (2009) Modelling and trading the EUR/USD exchange rate at the ECB fixing. The European Journal of Finance 16(6): 541–560

Ferreira C. (2001) Gene expression programming: A new adaptive algorithm for solving problems. Complex Systems 13(2): 87–129

Ferreira T., Vasconcelos G., Adeotato P. (2008) A new intelligent system methodology for time series forecasting with artificial neural networks. Neural Processing Letters 28(2): 113–129

Fukunaga, A., & Stechert, A. (1998). Evolving nonlinear predictive models for lossless image compression with genetic programming. In Genetic programming 1998: Proceedings of the third annual conference (pp. 95–102). Wisconsin: Morgan Kaufmann.

Georgopoulos, E. F., Zarogiannis, G. P., Adamopoulos, A. V., Vassilopoulos, A. P., & Likothanassis, S. D. (2008). A genetic programming environment for system modeling. In Proceedings of the 5th Hellenic conference on artificial intelligence (SETN08), October 2–4, 2008. Syros: SETN.

Georgopoulos, E. F., Adamopoulos, A. V., & Likothanassis, S. D. (2009). Genetic programming modeling and complexity analysis of the magnetoencephalogram of epileptic patients. Information Systems Development, 383–391. doi:10.1007/b137171_40.

Gomesda C. S. (2008) Time series forecasting with a non-linear model and the scatter search meta-heuristic. Information Sciences 178: 3288–3299

Hanias M.P., Curtis G. (2008) Time series prediction of dollar\euro exchange rate index. International Research Journal of Finance and Economics 11: 154–163

Holland J. (1975) Adaptation in natural and artificial systems. University of Michigan Press, Ann Arbor

Karathanasopoulos A., Theofilatos, K., Leloudas, P., & Likothanassis, S. (2010) Modeling the ASE 20 Greek index using artificial neural networks combined with genetic algorithms. Lecture notes in computer science LNCS (including subseries lecture notes in artificial intelligence and lecture notes in bioinformatics) (part 1, vol. 6352, pp. 428–435). Thessaloniki: Artificial Neural Networks

Koza, J. R. (1990). Genetic programming: A paradigm for genetically breeding populations of computer programs to solve problems technical report STAN-TR-CS 1314. Stanford: Stanford University.

Koza J. R. (1992) Genetic programming: On the programming of computers by means of natural selection. MIT Press, Cambridge

Koza, J.R. (1998) Genetic programming. In Williams, J. G. & Kent, A. (eds.) Encyclopedia of computer science and technology (vol. 39 24, pp. 29–43). New York: Marcel-Dekker

Lisboa, P., & Vellido, A., (2000). Business applications of neural networks. In Business applications of neural networks: The state-of-the-art of real-world applications. Singapore: World Scientific.

Madár, J., Abonyi, J., & Szeifert, F. (2004). Genetic programming for system identification. In Proceedings of the intelligent systems design and applications (ISDA 2004) conference. Budapest: ISDA.

Pacelli V., Bevilacqua V., Azzolini M. (2011) An artificial neural network model to forecast exchange rates. Journal of Intelligent Learning Systems and Applications 3: 57–69

Thinyane H., Millin J. (2011) An investigation into the use of intelligent systems for currency trading. Computational Economics 37: 363–374

Thomson R. (2009). Thomson Reuters datastream. Retrieved July 30, 2009 from http://online.thomsonreuters.com/datastream/.

Tsang E.P.K., Butler J.M., Li J. (1998) EDDIE beats the bookies. Journal of SOFTWARE—Practice and Experience 28(10): 1033–1043

Vapnik V. N. (2000) The nature of statistical learning theory. Springer, New York

Vassilopoulos P., Georgopoulos E., Keller T. (2008) Comparison of genetic programming with conventional methods for fatigue life modeling of FRP composite materials. International Journal of Fatigue 30(9): 1634–1645

Werner J. C., Fogarty T. C. (2001) Genetic programming applied to collagen disease & thrombosis. South Bank University, London

Willis, M. J., Hiden, H. G., Marenbach, P., McKay, B., & Montague, B. (1997). Genetic programming: An introduction and survey of applications. In Second international conference on genetic algorithms in engineering systems (pp. 314–319). Pittsburgh: GALESIA.

Winkler, S., Affenzeller, M., & Wagner, S. (2004). Identifying nonlinear model structures using genetic programming techniques. In Cybernetics and systems (pp. 689–694). Austria: Austrian Society for Cybernetic Studies.

Yu T., Chen S., Kuo T. W. (2004) A genetic programming approach to model international short-term capital flow. Applications of Artificial Intelligence in Finance and Economics 19: 45–70

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vasilakis, G.A., Theofilatos, K.A., Georgopoulos, E.F. et al. A Genetic Programming Approach for EUR/USD Exchange Rate Forecasting and Trading. Comput Econ 42, 415–431 (2013). https://doi.org/10.1007/s10614-012-9345-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-012-9345-8